BECOME A BETTER INVESTOR

Using Technical Analysis

Learn

Trend identification, techniques & short-cuts

Manage

Investment risk & reward & trade psychology

Profit

Better asset choices, entries, holds & exits

Get a head start, register for our free tutorial

TECHNICAL ANALYSIS

World Class Tuition from Professionals

At LTAG we can help you become the best investor you can be. We’ll show you how to use Technical Analysis to make pro level decisions that you may have thought you’d never know how to do. We have a range of service offerings that will fit in with your timetable and budget. You’ve come to the right place. Explore the site and find out how you can begin.

INVESTING IS NOT EASY IT'S BEST TO SEE THE WHOLE PICTURE TO BE ABLE TO MAKE CONSISTENT PROFITS

Making investment decisions that grow your wealth is not easy. Fundamental information or macro-economic information helps but is not the whole picture. Knowing how to read markets using Technical Analysis is an additional piece most investors don’t have. In addition, there are crucial investment aspects of risk & position sizing, comparatives, stop loss, price targets, trading systems, portfolio considerations & cognitive bias that need to be understood.

It sounds a lot and if you don’t know where to start it can be. At LTAG we’ve done the heavy lifting and can teach you quickly what works and what doesn’t. What you really need to know and what you can ignore.

THE REALITY IS THAT QUICK TIPS ARE NOT ENOUGH

We often get asked for quick tips, or what is the best investment system, or where will prices go next, or which candlestick pattern to use, and many other questions like these. The truth is that while the answers may help for a short while, rapidly they won’t be appropriate anymore and you will lose money.

Rather than provide tips, at LTAG we teach you a comprehensive set of Technical Analysis techniques that will improve your entries and exits. Entries and exits are the essence of investing. If we all knew what to buy, when to buy, at what price and when to exit that would be perfect. An LTAG course will get you nearer to that goal.

LEARNING TO INVEST DOESN’T HAVE TO BE COMPLEX

You don’t need a hugely long tuition programme to become a good investor you just need the right tuition programme. LTAG Technical Analysis tuition specialise in helping you see the wood for the trees. Simplification but effectiveness is at the heart of the tuition approach from LTAG.

We have had clients who have previously been investors for decades who tell us that in a few straightforward sessions they have become much better investors. We like to think of it as helping you to know what you didn’t know. We do that clearly, simply, practically and in a well-structured fashion that works.

ONCE LEARNED READING FINANCIAL MARKETS IS A SKILL YOU’LL NEVER LOSE

There are no coincidences in the market, every price movement has a reason. It’s unlikely to be a single factor so knowing how to read the market in multiple different ways will give you an edge that others don’t have. You can buy when others sell, hold when things seem grim, or sell when others are being greedy.

Despite the complexity of financial markets, there are proven ways to invest wisely and manage your risk. Technical Analysis helps you to understand the factors that influence market prices and by developing a sound investment strategy, you can increase your chances of achieving your financial goals.

Once you have these skills they’ll never leave you.

TUITION

Build up your expertise

LTAG tuition can be in the form of on-line courses, one-on-one personalised tuition to solve your specific problems, or a subscription approach that blends the two. Whichever option, over time you will grow from a basic understanding of price action and momentum to in depth know how of market cycles and risk management.

COURSES

BASIC, INTERMEDIATE & ADVANCED TA

Characteristics of financial markets, trading using price action, key indicators, cyclic analysis, trade management and much more.

1 ON 1

SUBSCRIPTION

Regular TA Updates on stocks/assets of popular interest

Value for Money

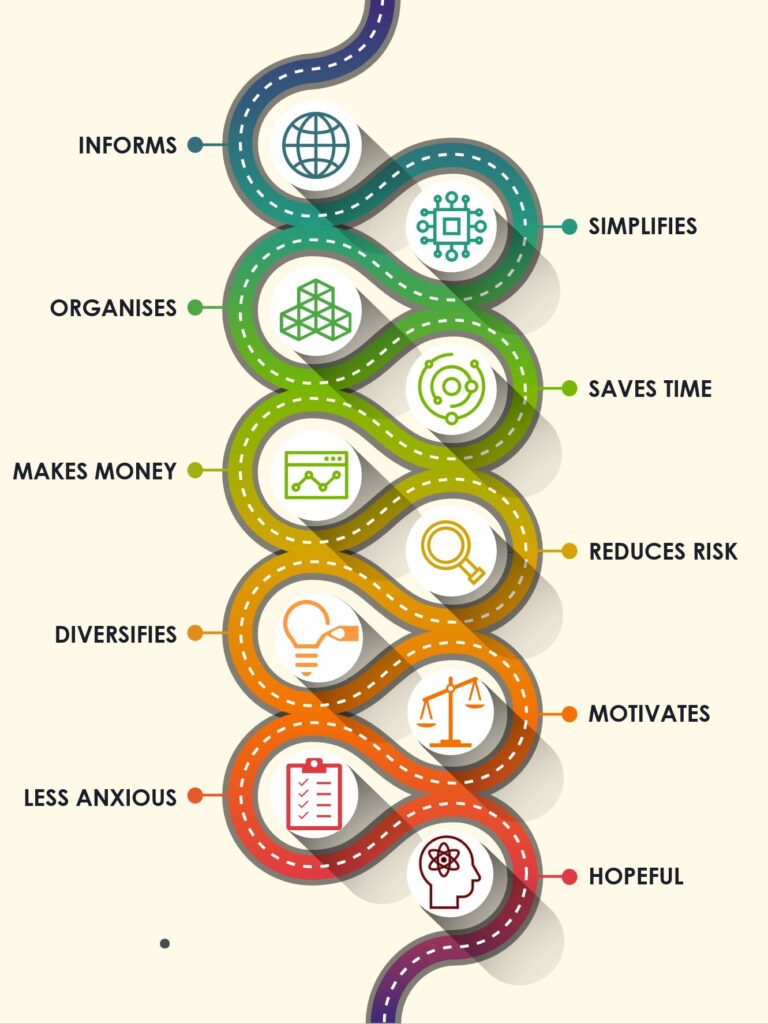

Value is seen differently by each of us but our experience is that there is a definite value chain. We call this the LTAG Investment Value Chain. Our tuition options are designed to make sure each of the elements in the value chain are achieved by our clients.

Normally our clients start with the need to know more and they progress to making better investments more safely to finally being hopeful that there is a well understood future.

Our testimonials and reviews confirm that our clients have found that even before they complete their courses they are already deriving value and benefit.

Success in financial markets does come down to making better decisions. That comes from know-how and practice. Throughout our tuition programmes we use a real trading platform so that you can see clearly stock price and volume of trade movements and practice yourself what you learn.

Some Client Results

Geoff Hart

Paul O’Dwyer

Lead Tutor

I’ve been an investor for many years and have always used a combination of fundamental, macro and technical analysis to guide my investments. Over the last 9 years I’ve used technical analysis a lot more because it gives me a real edge on the market. Most fund managers struggle to beat the index. I’ve beaten the index on a compound basis by many degrees for many years.

Recently some friends asked me to put together technical analysis tuition that would enable them to improve their investments as well. I thought that would be a great idea and created LTAG in early 2023.

Previously, I was a former KPMG London consulting managing partner with over 40 years’ global experience. I’ve successfully established a variety of business start-ups, listed a major company on the New York Stock exchange and managed strategy consulting, information technology and renewable energy, companies in the UK, Asia, Middle East and Africa.

My style is to bring clarity to complexity, to make the difficult easy and to do so with patience and professionalism.

Hear a bit about me

Frequently Asked Questions

Some frequently asked questions, there are more on our FAQ’s page

How do I ask questions as the tuition progresses?

Each tuition option has its own start date and participants will be part of dedicated chat channel for the duration of that programme. As far possible, we share questions and answers in a group so everyone benefits.

Do I need to have any advance knowledge of Technical Analysis?

No, for courses tuition starts from basics and progress. For subscription and 1on1 everything will be self contained.

Can I go at my own pace and do video sessions as and when I have the time?

Yes, the courses & subscription service are on-demand videos which you can view as and when and also go back to as required. 1on1 is as scheduled with you.

For courses, is it better to start on one course and upgrade as necessary?

It’s up to you. The advantage of being in one group from the beginning is the continuity you’ll develop amongst participants.

Do you have live Q&A session?

Yes, for Courses and Subscriptions there are regular live sessions which are also recorded and sent to participants. 1on1 sessions are also recorded and forwarded to you.

How will I access the tuition videos?

A secure, password protected, link will be sent to you for each session on-demand video as and when they are scheduled.